What is ATR? Calculation Formula and Usage (Specific Usage)

ATR is an indicator that measures market volatility and helps traders understand the market’s predictive uncertainty and develop appropriate trading strategies. This article will help you understand how ATR can help you manage risk and make entry/exit decisions.

First, we will cover the basic meaning and formulas of ATR. Then, realistic trading scenarios and specific strategies used by professional traders will be presented. Therefore, this article will also provide you with practical insights; knowledge of ATR is one of the essential elements for a trader’s success. Use this article to understand the essence of ATR and how to utilize it to minimize your risk of loss and maximize your profits.

What is [FX] ATR?

What does ATR mean and how does it help in forex trading?

First, let’s talk about the meaning of ATR. ATR stands for Average True Range, which in Japanese translates to “average of true price range.

In a nutshell, ATR is an indicator that measures market volatility. This indicator measures market volatility and indicates the actual range of price changes on a given day. As a result, it helps traders understand the market’s predictive uncertainty and properly manage risk. Let’s take a closer look at its features and benefits.

Feature

ATR is a calculation of how much the currency pair/issue shown in the chart has fluctuated on average over a certain period of time in the past.

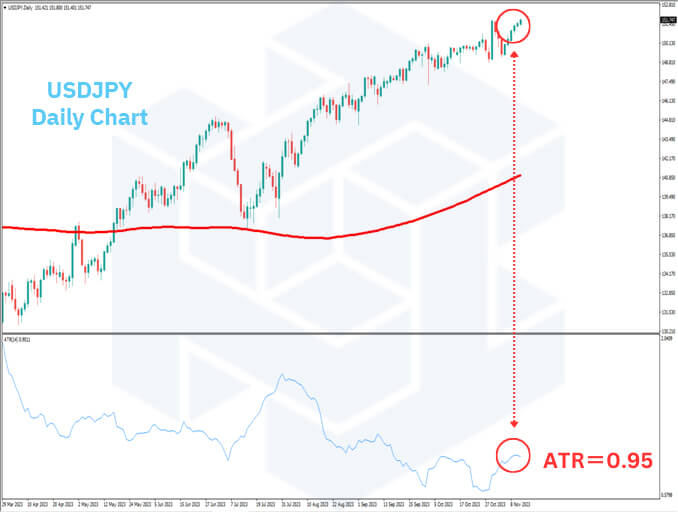

For example, the chart below shows the daily price of the dollar.

The daily ATR for the dollar-yen (14) = 0.95. This means that the dollar has moved an average of 0.95 yen (95 pips) per day over the past 14 days. Knowing this number can give us clues to predict future currency movements; a high ATR number means large price movements and high trading risk, but also many opportunities for profit.

Conversely, a smaller number indicates less price movement and a relatively stable market. ATRs are very useful when planning a transaction, deciding how much to trade and when to buy or sell.

In addition, watching ATR can help you prepare for such fluctuations, especially when there is major economic news or when the market is about to change suddenly.

Advantages of ATR

ATR is a measure of how likely prices are to change in the foreign exchange market. Knowing this, you can predict currency movements and make a good trading plan. It can help you predict whether the value of the exchange rate is going to go up, down, or stay the same.

For example, you can use ATR to figure out how much risk you are willing to take on a trade and decide where to stop your losses (stop loss) in case of an emergency. When the market is busy and currency values move widely, you can start cautiously with a small amount, and when the market is calm, you may be able to trade a little more boldly.

ATR is also used to determine whether market movements are within a certain range or whether new movements are about to begin.

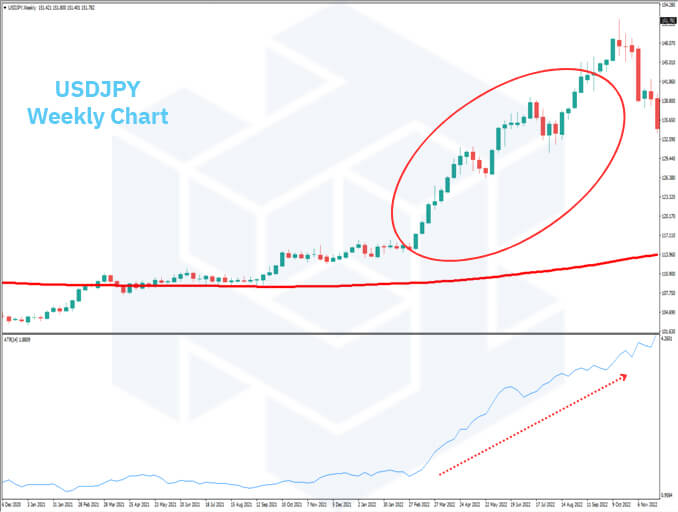

The above chart is a weekly chart of the dollar-yen, and you can see that the ATR graph has risen all the way up as the 2022 uptrend has begun.

Before the trend occurred, the price movement was about 1.5 yen (150 pips) per week, but after the trend occurred, the price moved higher and higher, and by the end of 2022, the average price movement was 3.8 yen (380 pips) per week. This is a much larger price range than in the past and can be noted as a sign that a trend is developing.

In addition, the dollar-yen is often considered a stable currency pair, but by looking at the ATR, you can check numerically whether the currency pair is currently stable in price movement.

It is a simple technical indicator that offers many advantages, such as finding good trading timing and targeting profits while managing risk. It is easy to understand even for beginner traders, and we encourage you to use ATR as a basic tool to help you make trading decisions.

Let’s take a closer look at some of the specific benefits. We will delve into the following three

・The magnitude of volatility can be measured

・Able to identify trends

・Helping you manage your money

The magnitude of volatility can be measured

Volatility, or the magnitude of price movements in the market, is very important in trading. This is measured by an indicator called ATR, and a high ATR is a sign that prices are moving up or down significantly, which can lead to significant risk or profit in your trading. This number can be used to determine the amount of money to trade with or to plan what to do if the market moves suddenly.

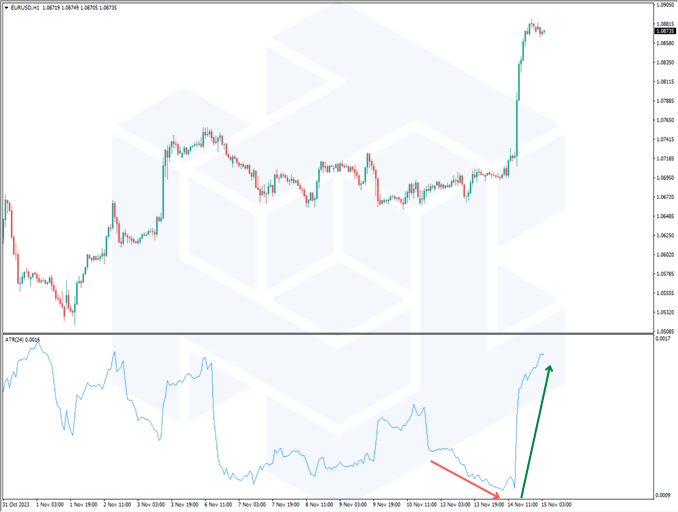

For example, if the ATR seen on an hourly basis is larger than usual, it means that the price movement was greater than expected at that time. In such a case, you might trade with less money to be on the safe side or reduce the volume of your trades to lower your risk. By checking ATRs in this way, you can trade well even when the market is unstable and aim for profits while managing your risk appropriately.

ATRs often rise sharply before major economic news or events. At such times, prices can change dramatically, so you should trade with extra caution. ATR is also an important tool for trading when markets are difficult to predict.

Able to identify trends

By looking at the ATR, or the average range of price movements in the market, you can get an idea of where the market is now and what trends are occurring. when the ATR is rising, the market is active and prices may fluctuate significantly up or down. This is a sign that a new trend may be starting.

Conversely, a falling ATR indicates that market activity is calming down and the possibility of a major price change is decreasing. In addition, a sudden rise in ATR after a period of small market movement is a warning signal that prices may break out significantly.

For example, if the dollar-yen daily chart shows ATR (14) = 1.5, it means that the price has fluctuated an average of 1.5 yen per day over the past 14 days. When volatility is higher than in the past, it is good to note that a trend may be developing.

Helping you manage your money

With ATR, you can better manage how you spend your money in trading. When market price movements are large, it is important to decide where to set your “stop loss” to limit your losses. This is so that if the market moves differently than expected, you can cut your losses within a pre-determined range.

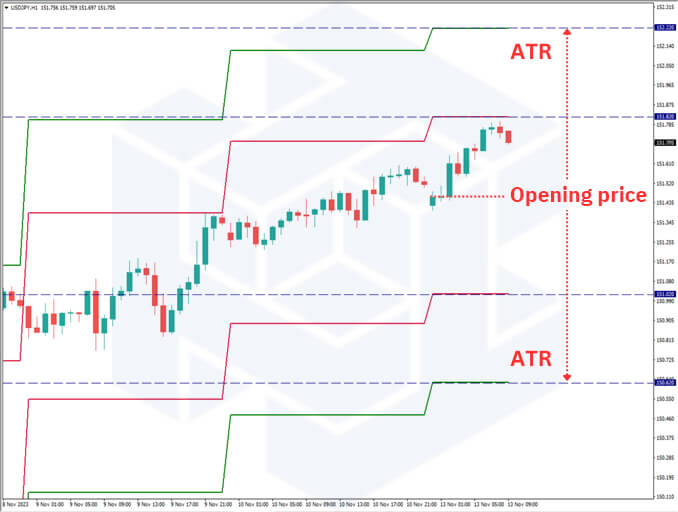

Specifically, “ATR x 2” can be used as a trailing stop level. This is effective when targeting as large a trend as possible. Considering the following 1-hour chart of the dollar-yen, “ATR = 0.089 (8.9 Pips)”. In this case, considering the stop loss value as “8.9 Pips x 2”, the stop loss value could be set at “about 18 Pips”. Each time the candlestick updates, the stop loss value is changed; with ThreeTrader MT4, it can be set automatically.

In addition, you can adjust the size of your trading position, i.e., how much you invest, while watching the ATR.

For example, when the ATR is higher than usual, it is a sign that the market is moving more than expected and you should reduce the volume of your trades to limit risk. In this way, losses can be minimized even when the market changes suddenly.

It is also important to check the ATR and readjust your stop loss position before major economic news or when prices are about to change suddenly. This will make you less susceptible to sudden market fluctuations, protecting and increasing your capital over the long term; ATR can also be a useful tool to help you decide how much risk you are willing to take when trading.

[FX] ATR Calculation Formula

ATR is a valuable tool in forex trading, but knowing its calculation formula is essential to its accurate understanding and utilization. This section clearly explains the ATR formula. Understanding the formula will also give you insight into how to read ATR on a chart and help you determine your trading strategy. In fact, let’s take a look at the calculation formula.

Calculation Formula

ATR is an indicator that shows the average of how much prices fluctuate in a market where prices are constantly changing, such as the foreign exchange market. The calculation uses a value called the True Range of Change (TR), which simply indicates how much prices have moved within a given period of time.

Specifically, the largest difference among the following three price ranges is used as the “ATR” value.

・Difference between the highest and lowest price of the day

・Difference between the higher price on the day and the price at the end of the previous day

・Difference between the end price of the previous day and the low price of the day

This true fluctuation range is calculated as an average over the chosen time period (e.g., 14 or 20 days), and that is the value of the ATR. Generally, “14” is used, but it can be changed depending on the time frame and trading method.

How to Read Charts

The ATR helps you visually understand how active the market is on the chart.

For example, a high ATR value means that the market is active and there are large price movements, which requires more careful consideration of risk when trading.

Conversely, a low ATR value indicates that the market is relatively stable and major price movements are rare. Understanding this will help you to better select the timing of your trades and avoid missing profitable opportunities.

ATRs also help you trade wisely because they help you determine when to take advantageous positions when planning your trades and when to leave the market to minimize losses.

[FX] How to use ATR

Success in Forex requires an understanding of market volatility and the skill to incorporate it into trading strategies. This section focuses on how ATR can be used in specific trading techniques and risk management, and explains its usefulness.

Let’s start by looking at its application to trading methods.

Trading method

By checking the ATR value, you can determine when to start (enter) or end (exit) a trade.

For example, when the market is busy and prices are moving widely, there is an opportunity to aim for large profits, but it also entails a large amount of risk. On the other hand, when the market is quiet and prices are moving slowly, you can aim for stable profits with little risk.

When ATR is high, prices are more volatile, so you can trade carefully with less money and keep your losses small if your predictions are off.

Also, by looking at ATR, you can catch signs of when a new trend may be starting in the market, or conversely, when the current trend may be ending. By doing so, it is possible to make a good distinction between a strategy to profit by riding the market trend (trend-following strategy) and a strategy to profit by going against the market change (contrarian strategy).

If you make good use of this information, you will improve your forex trading skills and be closer to success.

Risk management

Using ATRs can help you manage the risk of your trades and show you how to protect your money from sudden market fluctuations. For example, ATR can help you set a stop loss line (stop loss) in advance so that you do not lose money due to unexpected price changes. This allows you to limit your losses to a limited range, even when the market suddenly changes.

The ATR can also tell you whether the market is stable or volatile right now. Based on this, you can decide how much risk you are willing to take on a trade. For example, when the market is unstable and ATR is high, you might trade a little more cautiously and take a smaller risk. When the market is stable and the ATR is low, you might take a little more risk.

In FX trading, sudden price fluctuations can cause large losses, but by using ATR, it is possible to identify such risks in advance and deal with them successfully. Therefore, ATR is a very important tool for trading. Before you start trading, it is recommended that you understand and utilize ATR.

Utilizing ATR with ThreeTrader

With TreeTrader, you can trade smarter by using ATR, which shows you how much the exchange rate will move in the future, helping you decide when to start and end a trade.

TreeTrader provides a daily report every weekday morning that analyzes the most recent market price, which may be based on “support” or “resistance” figures based on ATR.

Knowing this in advance can help you prepare for a sudden move in the exchange rate. If prices move often, you may want to trade cautiously with less risk; conversely, if the market is calm, you may want to trade a little larger.

Even first-time traders can successfully trade using the information provided by ThreeTrader.

Determine the price level of psychological milestones

When trading currency, where to buy or sell is an important decision, and ThreeTrader reports sometimes include “psychological milestone” numbers, calculated based on the ATR, at which the currency is likely to change.

This is a price that many traders are psychologically aware of, and knowing this number will make it easier to find good trading timing.

Specifically, the “opening price + ATR, opening price – ATR” price level. Experienced traders are familiar with these figures, but they are not often presented in public materials; ThreeTrader has the advantage of being very accurate because of its narrow spreads and its ability to reflect market price levels as closely as possible.

Of course, you will not react every time, but knowing the psychological milestone price levels derived from the ATR will help you respond well to unexpected moves.

With ThreeTrader, you can check these important numbers daily and trade wisely. It also offers very narrow spreads, which minimizes your trading costs.

Click here to open a live account

Summary|What is FX ATR?

In this article, we explained ATR in detail. First, we clarified what ATR is and what its calculation formula is. Then, we focused on how to utilize ATR, introducing specific trading techniques and risk management methods.

ATR measures market volatility and provides essential information for traders when trading in Forex. By understanding the exact formula and knowing the range of price volatility for the day, you will be able to minimize the risk of your trades and effectively set entry and exit points.

Apply the knowledge gained in this article to your trading as soon as possible to reduce the risk of loss and maximize profits.