What is a Forex Bear Trap? How to recognize (how to avoid and utilize)

To be successful in the Forex (foreign exchange) market, it is important to understand the various trading strategies and to avoid falling into their traps. One of the most important of these is the “bear trap,” which is one of the most important factors for traders to know about. In this article, we will discuss bear traps in detail and show you how to identify, avoid, and take advantage of them.

By reading this article, you will learn more about bear traps, improve your trading skills, minimize your risk of loss, and maximize your profits.

First, we will explain the essential aspects of bear traps in forex trading.

What is a bear trap?

A bear trap is a phenomenon in which a market trend appears to be temporarily down when, in fact, the market reverses to an uptrend. Bear traps are traps that make trading difficult and can result in losses.

We will explain how it works with specific examples. Let’s get to the essence of bear traps.

Structure

A bear trap is a series of “false market down signals” followed by a sudden uptrend.

Bear traps give false signals that make it appear as if the market is in a downtrend. In other words, it makes it look like the market is going down when in fact it is not. Next, a “short-term price drop” occurs. This means a temporary drop in market prices. At this time, many people believe that sellers are prevailing in the market and try to go with the flow.

In reality, however, a “sharp rise” occurs that causes an uptrend to occur. In other words, market prices drop only temporarily, but quickly return to their original uptrend. This sudden change confuses traders who are unable to properly understand the market’s change.

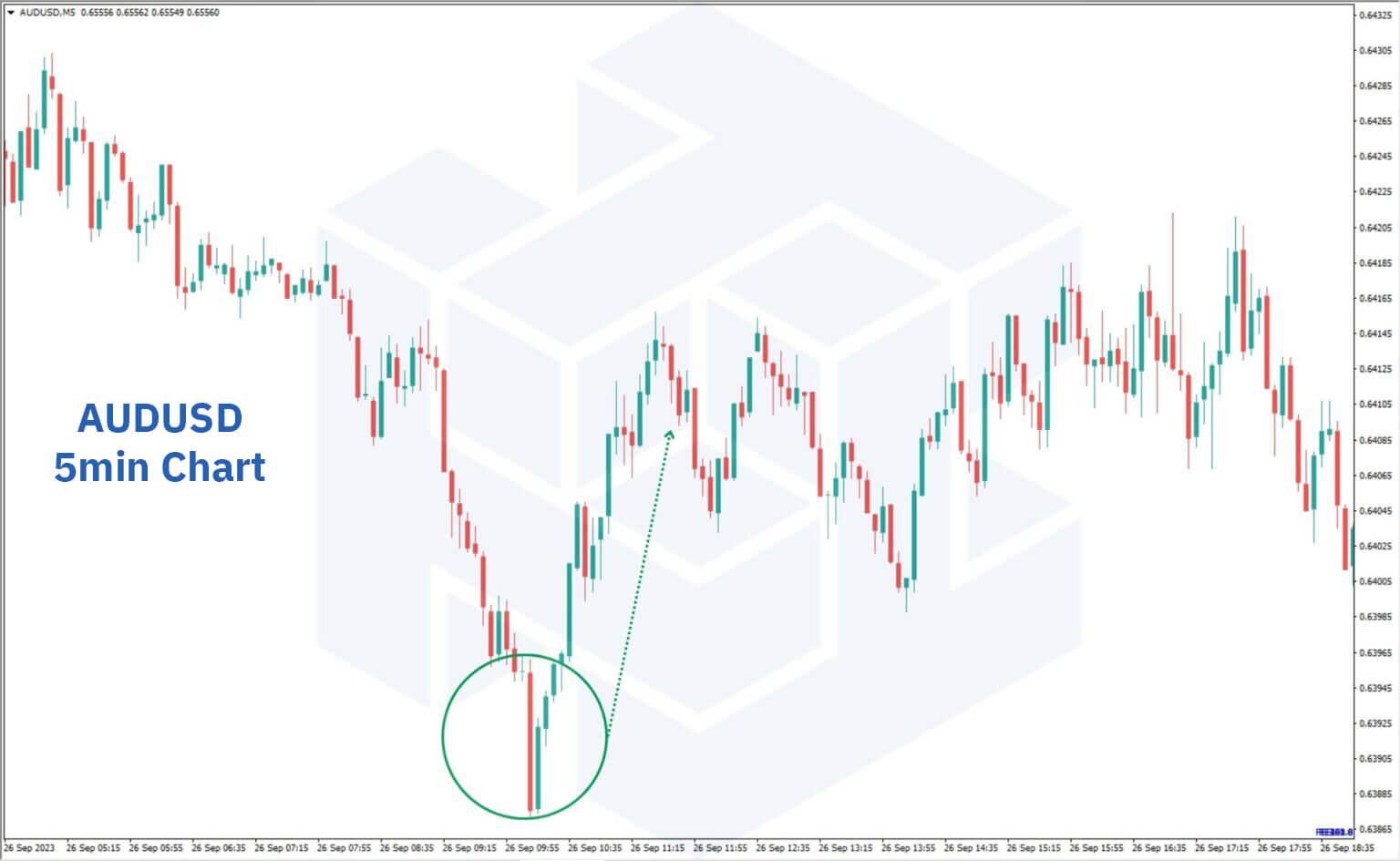

For example, below is a 5-minute chart of the Australian dollar. The downtrend is continuing, and some traders hold a sell position to avoid missing the trend at the point of a sharp drop. However, the sharp drop was the lowest part of the price and then it started to rise.

As in the example above, “trader confusion” creates the risk of misjudging market changes and taking the wrong position.

For example, there is a risk of taking a sell position thinking the market is falling, but the market suddenly rises, resulting in a delay in cutting losses and consequently a large loss.

Concrete example

The phenomenon of bear traps occurs from time to time in forex trading and may be difficult to understand, especially for beginners.

First, a “short-term price plunge” means a sudden drop in the price of a given currency pair. For example, let’s consider the dollar-yen. Suppose the value of the dollar suddenly drops significantly (dollar depreciation). In this situation, many traders choose to sell the dollar. This is because they believe that the price will fall further.

The dollar’s strength or weakness can change depending on stock indices, economic indicator releases, statements by key figures, and news headlines. Therefore, it is necessary to understand not only the currency pair you are trading, but also the overall market trend.

Next is the “support line breakout”. A support line is a specific level at which prices fall but do not go below easily. In a bear trap, however, the price may temporarily fall below this support line.

The trader thinks the price will fall further and takes a sell position. In reality, however, it may be a dupe.

Below is a 30-minute chart of the pound sterling, which fell sharply for a moment, then quickly recovered. Then it moved to a downtrend again and then rallied all the way up. Cross yen tends to move violently and has large false moves, so it is necessary to carefully assess the correlation between currencies.

In a “market reversal,” prices recover rapidly from a decline. This sudden change can result in unexpected losses for traders who had a sell position. In other words, they sold in anticipation of a price drop, but the price actually rises and they lose money.

Finally, the influence of institutional investors can create misunderstandings in the market. This can lead individual traders in the wrong direction. Information that a major investor has started to sell can cause many traders to start selling as well, when in fact the market may move in the opposite direction.

How to recognize a bear trap

In the foreign exchange (FX) market, spotting bear traps is a difficult task, but useful clues do exist. The following three factors can help you to keep an eye out for signs of bear traps hidden behind price fluctuations.

- Support and resistance lines

- Candlestick

- Highest foot

In this section, the above indicators will be discussed in detail. Master these tools and trade with confidence without falling into the bear trap.

Support and resistance lines

In forex trading, it is important to know two terms: “support lines” and “resistance lines”. They help predict how market prices will move.

First, a “support line” is a certain level at which prices do not fall easily below. When this line is reached, prices are likely to rise again. Conversely, a “resistance line” is a level that is not easily crossed even when prices rise, and prices often fall when this line is reached.

A move through these lines may be the start of a new trend, or conversely, it may be a sign of falling into a trap called a “bear trap. A bear trap refers to a phenomenon in which market prices appear to drop temporarily, but actually quickly return to their original levels.

Therefore, it is important not to start trading immediately after a support or resistance line is breached, but to wait a bit to see if the move is genuine. For example, if the price goes below the line but comes right back up, it may be a bear trap.

Thus, in forex trading, it is important to watch price movements carefully and trade wisely. Understanding support and resistance lines and analyzing their movements can help you avoid bear traps and trade better.

Candlestick

In forex trading, a tool called a “candlestick chart” is often used to understand market movements. This is a chart format that visually shows price fluctuations over a specific period of time.

In candlestick charts, it is important to identify different patterns. For example, when a large shadow (a candlestick indicating that prices have fallen) suddenly appears, it signals a possible change in the market trend. When such a shadow appears while the market is in an uptrend, it means that there is an increased likelihood that the market will turn into a downtrend.

There is also a pattern known as a “wrap-around leg”. This is a pattern in which a positive line (a candlestick indicating that prices have risen) is followed by a large negative line, and can be seen as a sign that the market is in a bear trap. In other words, it indicates a situation where prices appear to be rising, but in fact may soon fall sharply lower. In addition, certain candlestick patterns can also be a sign of market “contrarianism. Contrarianism is the strategy of trading in the opposite direction when a large number of market participants are moving in one direction. For example, if the market is in an uptrend and suddenly a large shadow appears, this could indicate a possible change in the market’s movement.

Highest foot

The upper leg is a chart that shows market movements over a longer time frame, such as daily or weekly. By analyzing these, the overall trend of the market, not just the short-term movements, becomes clearer. In other words, it allows us to understand the market trend over a longer period of time than just one day’s movement.

It is also important to understand the relationship between short-term and long-term trends.

For example, if the hourly chart is rising, but the daily chart is in a downtrend, the short-term rise may be part of a long-term downtrend. In this way, the charts of different time frames can be compared to capture the overall market trend.

In addition, “multi-timeframe analysis” is a method of analyzing these multiple timeframes simultaneously. This enables more accurate trend analysis by simultaneously identifying both short-term market fluctuations and medium- to long-term trends.

How to avoid bear traps

To escape bear traps and be successful in trading, specific strategies and approaches are needed. In this section, we will focus on how to avoid bear traps and explore tactics that can be beneficial to traders.

It will also explain what to do if you fall into a bear trap. Understanding how to get out of trouble and back on a positive track is critical for traders.

In addition, we will discuss how to take advantage of bear traps in your trading and discuss methods to turn miscalculations into opportunities. Through this section, you will learn how to confront the dangers of bear traps and move steadily toward trading success.

Identify trends

In forex trading, it is very important to understand how the market is moving. There is a major trend in market movements, which is called a “trend.

For example, prices may drop slightly over a short period of time, but may still be rising overall. To discern this, a trend-based tool such as a “moving average” can be useful. This is a technical analysis tool that shows the average price over a period of time as a line. By looking at this, you can tell whether the market is going up or down overall.

Below is a one-hour chart of the Eurodollar. This is the moment when the range is about to break out below and fall below the round number of $1.10.

However, the 72 moving average (3-day moving average) is clearly to the upside. Confirming the upper leg, the uptrend was continuing. Short-term trades are not a problem, but we need to hold positions keeping in mind that the major market trend is up.

We can then see that $1.10 is changing from resistance to support. If you held a sell position at this stage, you will need to think about cutting your losses.

The important thing is not to react immediately to small price fluctuations. It is important to always remain calm and think about market movements from a larger perspective.

Compare with past patterns

To do well in Forex, it helps to study how the market has moved in the past. Markets sometimes move similarly to the past.

For example, by looking at how the market reacted to any major news in the past, you may be able to predict how the market will move when there is another similar piece of news. Understanding market patterns can help you predict how they will move in future trades. Past market data is an important source of information, so make sure you use it in your FX trading.

The chart below shows the one-hour time frame of the dollar-yen at the end of October 2023. The dollar-yen was on a downtrend on the view that the BOJ policy meeting might implement a modification of interest rate policy.

However, there have been similar cases in the past, and in most cases, the policy revisions did not come as expected by the market and the yen weakened further against the dollar. Compared to past cases, the scenario that the dollar/yen will continue to rise at the end of October 2023 without a major policy correction as expected by the market can be considered.

In fact, at the end of October 2023, the policy did not change as expected by the market and rose from 148 yen to the latter half of 151 yen with no time to catch one’s breath.

View it as a long-term investment error

When you are trading forex, market prices go up and down every day. However, the important thing is not to be happy or sad about these short-term movements. It is very important to have a long-term perspective.

For example, if prices fall today, they may rise in the long run. Instead of overreacting to short-term market fluctuations, develop an investment strategy that thinks longer term.

When investing, it is important to diversify your risk. This is called “portfolio diversification. This means that you do not invest all of your money in the dollar alone, but rather divide it among many different types of stocks, such as other currency pairs, gold, stock indices, and so on. That way, if one market is bad, you may be able to cover it with other investments!

Also, do not be swayed by daily market movements. Markets are constantly fluctuating, and if you are distracted by small daily fluctuations, you will lose sight of your larger goals. It is important to focus on your long-term goals and develop a calm investment strategy. Short-term market movements often do not have a significant impact on your long-term goals, so it is important to remain calm and stay invested.

What to do if you get stuck in a bear trap

It is important to think about what to do when you are stuck in a bear trap in forex trading.

A bear trap is a situation where you invested thinking the market was going to go down, but the price actually goes up. The first and most important thing to do is to cut your losses early. This means that if prices fall more than expected, you should immediately stop investing to reduce your losses.

For example, if you hold a buy position in dollar-yen, but the price has fallen more than expected, you would let it go early to avoid an even bigger loss.

Next, it is important to reevaluate the status of your investment. The market is constantly changing, and as new information becomes available, you need to reevaluate your current investment plan based on it. Think about how the market has changed and adjust your investment plan accordingly.

Finally, it is also important to “strengthen risk management. It is important to learn from the experience of being stuck in a bear trap and be prepared for the next time something similar happens. Risk management means considering how much risk you are willing to take when investing. Learn from your mistakes and try to be more cautious the next time you invest and manage your risk appropriately. Situations like bear traps are a common part of forex trading, but by handling them well, you can become a better trader.

Supplement: Using Bear Traps in Trading

In forex trading, there are ways to take advantage of difficult bear trap situations and make a profit. The first thing you should know about is the “do-ten strategy. This is a strategy in which, when a bear trap is clearly identified, you sell your current buy position (in which you expect the price to rise) and start a new sell position (in which you expect the price to fall) instead. In other words, it aims to profit by reacting quickly to market movements and switching to the opposite position.

Understanding market psychology is also important. Look at how other traders are moving and predict bear traps based on their behavior. When many people are moving in the same direction, that may actually be a sign of a bear trap. By analyzing the actions of others in this way, you have the opportunity to spot bear traps and turn them into profits.

It is extremely difficult to predict when a bear trap will occur, but ways to respond can be thought of in advance.

Utilizing Bear Traps with ThreeTrader

There are ways to make good use of “bear traps” when trading forex. In particular, the ThreeTrader trading platform allows you to make good use of bear traps. Here are some pointers on how you can take advantage of bear traps with ThreeTrader.

First, ThreeTrader allows you to see charts of stock indices, gold, and dollar indices, in addition to currency currency pairs. This can be used to find signs of bear traps. For example, you will be able to analyze the trend when prices start to fall suddenly, or use oscillator systems to see if the trend is overheated or strong.

The market analysis report that ThreeTrader provides each morning will be helpful as you can use the right technical analysis tools for the market and get the day’s analysis.

When using TreeTrader, it is important to set stop-loss and take-profit points in advance; MT4, of course, allows you to set stop-loss and take-profit points in advance.

Taking advantage of bear traps with Threetrader is a great opportunity to improve your forex trading skills. If you use it well, you can turn market fluctuations into your profits.

Click here to open a live account

Summary|Bear Trap

This article details the nature of bear traps and how to overcome them. Bear traps carry potential risks in forex trading, but with the right knowledge and tactics, they can be an opportunity to avoid risk and maximize profits.

To recap the main points, a bear trap is a phenomenon in which a market trend appears to be temporarily down and the market actually reverses into an uptrend, which can be detected by utilizing support and resistance lines, candlesticks, and upper legs. In addition, confirming the trend, comparing it to past patterns, and viewing it as a long-term investment error can help avoid bear traps.

Even if you fall into a bear trap, it is important to remain calm and use tactics to minimize losses. Finally, we also discussed how to take advantage of bear traps in trading, and learned how to turn miscalculations into opportunities. By utilizing the knowledge and methods gained in this article, it is possible to minimize risk and maximize profits. We hope you will make use of it in your actual trading.