Diagonal FX – Leading and Ending Diagonal (How to use and what to watch out for)

This article provides a thorough explanation of diagonals from basics to applications with illustrations and examples. It has been compiled in a way that is easy to understand even without specialized knowledge of Elliott Waves. You will be able to understand how leading diagonals indicate new price phases and ending diagonals announce trend reversals, and how to make use of them in FX trading.

In forex trading, anticipating wave movements is the key to success. Through this article, you will learn the theory and practice of diagonals and acquire the ability to accurately capture the market’s turns.

We will begin by explaining the basics of diagonals.

What is FX Diagonal?

First, let’s get down to the essence of diagonals: what exactly is a diagonal in FX?

Briefly, diagonal is one of the patterns based on Elliott Wave Theory and refers to the movement of waves with a specific shape on a price chart. It is mainly noted as a sign of a trend change.

Diagonal patterns assume a certain law of price movement and provide traders with clues to market direction and change in the middle of a trend or at turning points. Let’s take a closer look at their characteristics and typical types.

Feature

Diagonals are patterns based on Elliott Wave Theory that provide important clues when analyzing market movements. Diagonals occur during the transition from wave 1 to wave 2 and from wave 4 to wave 5.

When a diagonal pattern is seen in the market, we consider that the current trend may be turning.

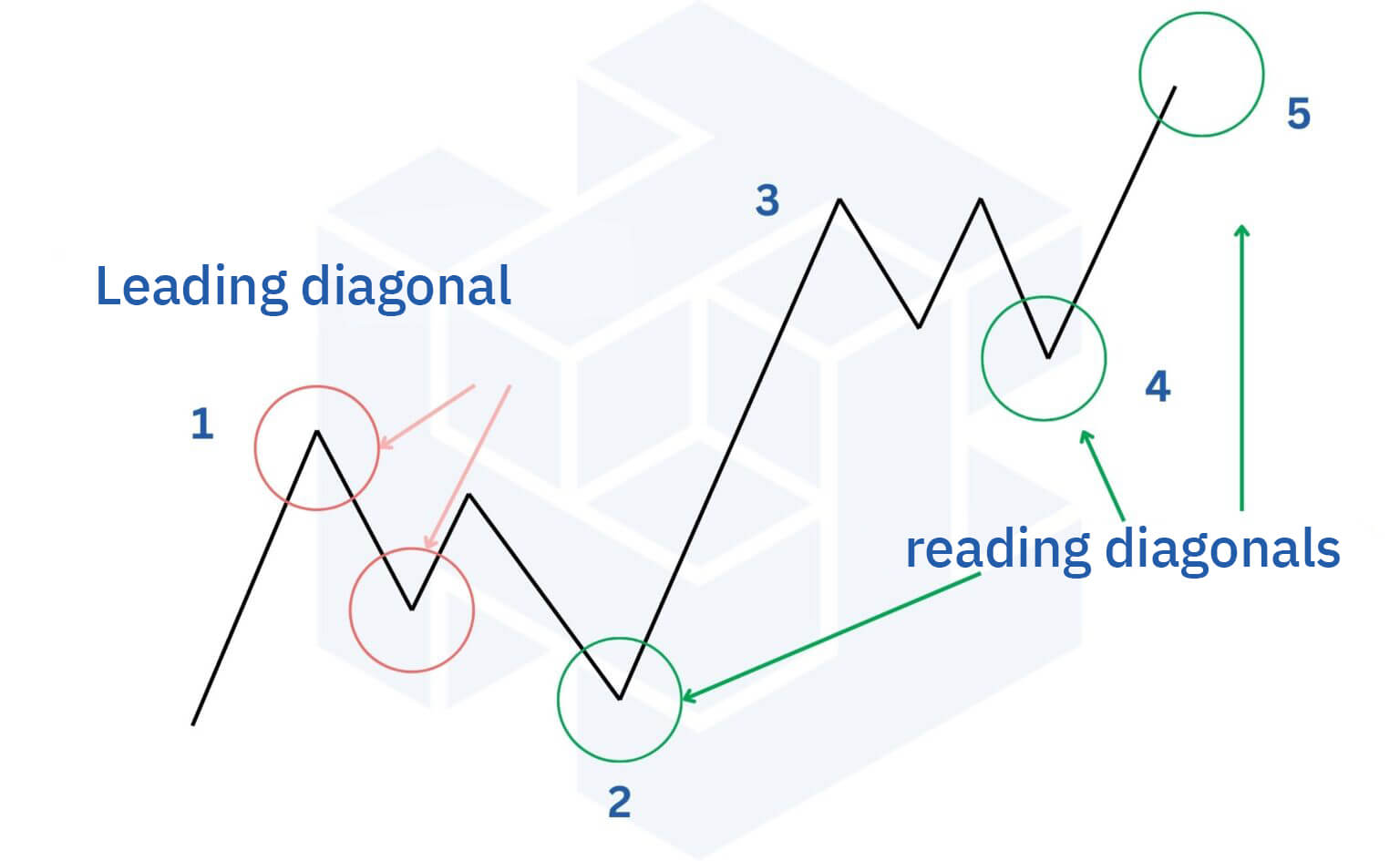

Diagonals are a form of propulsive wave consisting of five waves, which move in a zigzag shape. A characteristic feature of diagonals is that the first and fourth waves overlap.

Diagonals come in two shapes: a wedge-shaped contracting shape and an expanding shape. A contraction-type diagonal has a low that cuts up at a steep angle, while an expansion-type diagonal has a high that cuts up and a low that cuts down and gradually widens.

Practice is essential to finding diagonal patterns in the real market. At first, it may seem difficult to find them. Once you find diagonals in the market, you will be prepared for the next move. Closing a position or preparing for an entry can be of great benefit to the trader.

Diagonals that appear at market turning points are important signals that a trend may be weakening or nearing its end.

Type

There are two main types of diagonals. Leading Diagonals and Ending Diagonals. Each appears at different stages of the market, so let’s sort them out.

First, let’s talk about Leading Diagonals. Leading diagonals are patterns seen in the early stages of a trend, signaling the beginning of a new trend. In Elliott Wave Theory, it appears between the beginning of a trend and the second wave. If you can find this pattern, you can predict that the market will begin to show a new movement.

Next is the ending diagonal. This is a pattern that appears near the end of a trend and tells us that a trend that is already underway is about to end.

In particular, when an ending diagonal occurs in the later stages of a trend, it is a sign that the trend is nearing its end. If you suspect an ending diagonal, consider whether other indicators are also showing signs of the end of the trend, such as overbought levels in oscillator indicators or dead crosses of moving averages.

Once you find the ending diagonal of the trend’s exit phase, you are ready to identify the point to lock in profits.

If you can find an ending diagonal early in the trend, you can also anticipate the emergence of a third wave; the third wave is considered the most stable up period in a trend and provides an opportunity to extend profits.

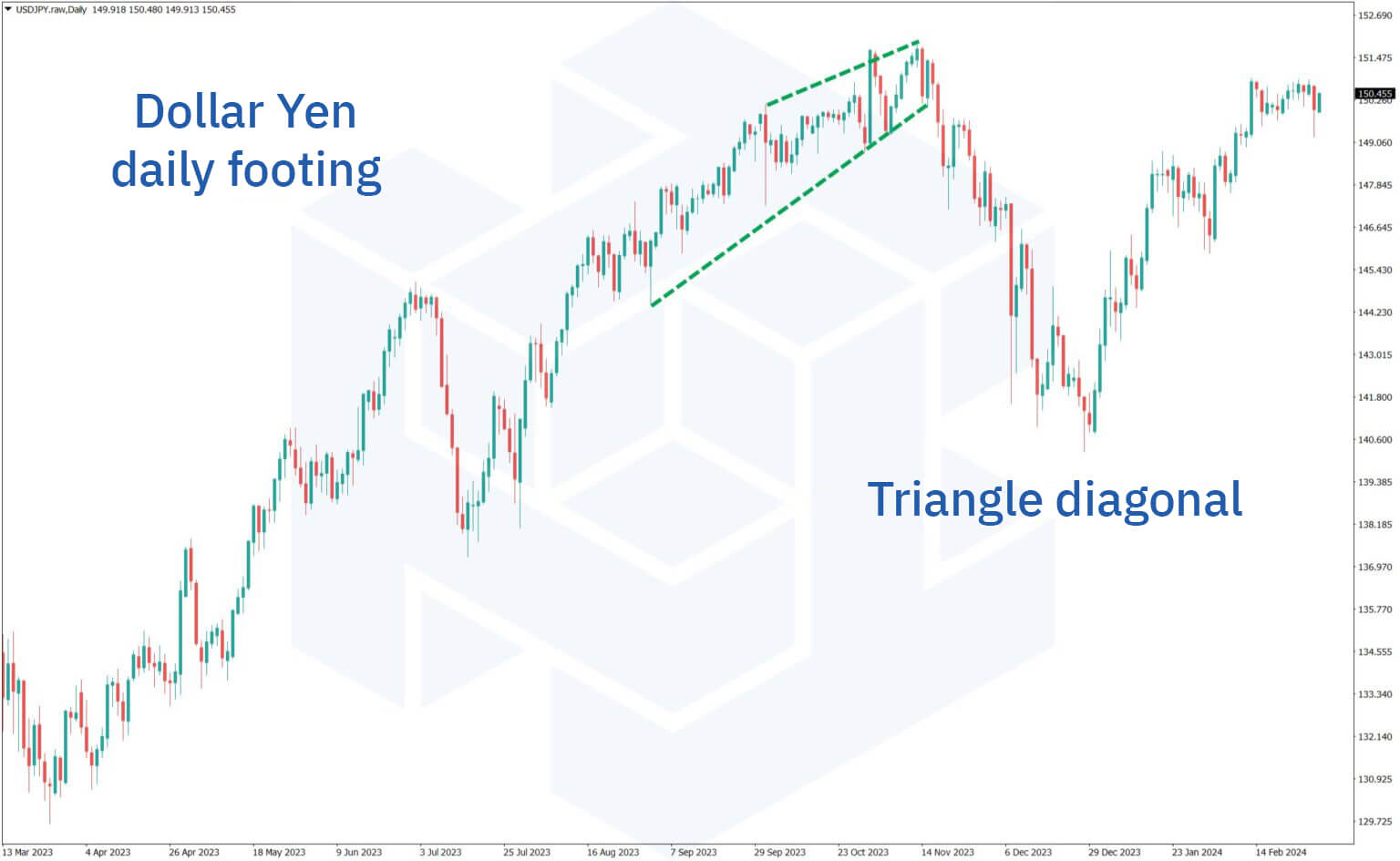

Supplement|Diagonal Triangle

Diagonal Triangle is a diagonal triangle pattern that appears at the end of a market. It indicates that prices are moving up and down in a gradually narrowing range and traders are looking for the next move. When a diagonal triangle appears, buy and sell orders become active, resulting in a zigzag movement.

Diagonal triangles are also considered a sign that a trend is nearing its end. Therefore, attention is focused on a breakout, a major move in price that occurs after the pattern. If there is a breakout, it indicates the end of a trend or a possible change in market direction.

Finding the diagonal triangle and successfully reading the subsequent move is critical to a smart investment strategy. By understanding the diagonal triangle, you will be able to predict the market’s next move to some extent and trade at a more advantageous point.

Leading diagonal

One of the most common patterns of diagonals, leading diagonals provide clues to the beginning of a new trend. Let’s take a closer look at its characteristics and specific examples. In addition, we will also introduce some practical applications.

Feature

Leading diagonals appear in the first wave (shock wave/impulse) or A wave of the Elliott Wave Theory and are an important sign that signals the beginning of a new trend.

Leading diagonals fluctuate violently up and down, forming a zigzag-like shape, and when you find one, it is important to be prepared for a major move. Check to see if an impulsive wave of one Elliott wave and a corrective wave of two waves have formed.

However, it is important not to make decisions based on leading diagonals alone, but to use them in combination with other analytical tools. The greatest profit opportunities in trend-following are in the three waves.

Leading diagonals are one clue to detect early signs of a new trend. Carefully consider the market’s future movements and develop a trading plan.

Concrete example

Below is an example of a contracting leading diagonal appearing on the daily chart of Gold.

The contractionary leading diagonal seen on the daily chart of Gold has formed a wedge shape with the lows rising rapidly in the first wave of Elliott wave theory after hitting the bottom.

After a contractionary leading diagonal forms, a breakout should be noted. In fact, the market has plunged from $1960 to around $1800.

The above market, where the Leading Diagonal emerged, was a major trend, rising from a low of $1622 to a high of $2082, which was a new all-time high at the time. For traders, this is an important clue to identify the turning point of a trend and prepare for the next major move.

It may be difficult to find leading diagonals in a moving market, but if you see a zigzagging movement or feel that the trend may have changed, it is recommended to consider whether diagonals are appearing.

Usage method

When using the Leading Diagonal for trading, if it appears in the early waves of an Elliott Wave, we believe that a major corrective wave may be coming. Specifically, we need to watch for a move where the lower line of the wedge is broken. Use the Fibonacci retracement to analyze in advance the price area where you can push the price.

It is also important to keep in mind that the third wave tends to create the most stable trend. However, not everything goes according to theory. Be sure to use basic analysis such as moving averages and oscillator-based indicators such as RSI in conjunction with your analysis.

Since diagonals can be subjective in their own favor, it is recommended that you try to analyze them from a neutral perspective when you are not holding a position.

Being aware of the leading diagonals will help you capture early market moves and prepare for subsequent major moves.

Ending diagonal

What are the characteristics of another typical pattern of diagonals, “ending diagonals”? Let’s take a closer look at it, along with specific examples and how to utilize it.

Feature

The ending diagonal is a pattern found in Elliott Wave Theory in the second wave before a rising market, the fourth wave before the last rising market, and the fifth wave at the end of a trend. When an ending diagonal appears, it is a signal that the market may change to a new direction.

Ending diagonals can be expanding or contracting and often form over a relatively short period of time. When an ending diagonal appears, it is a sign that the market is getting tired and that the market has lost its sense of direction.

Once you find the ending diagonal, be prepared for a market change. A new trend may be starting in the future, so don’t miss the signs.

Concrete example

Below is a chart image of an expanding ending diagonal appearing on the Gold daily.

Ending diagonals are easier to spot than leading diagonals. In the chart above, they appear in the shock wave (impulse) of the fifth wave, which is the final part of the trend.

In the final part of the trend, the price tends to rise sharply and end up forming a very steep upward price move. In the above market, the market window opened at the beginning of the week and rallied sharply, but after breaking out of the lower diagonal, the price eventually fell from the $2070 level to the $1800 level.

You can see that after the appearance of the ending diagonal, the uptrend has turned from an uptrend to a downtrend.

Usage method

Ending diagonals are easier to identify than leading diagonals. If the Ending Diagonal appears before a trend change, it can provide clues to improve trading accuracy. However, other indicators should also be checked to determine if the trend has truly changed.

Ending diagonals appear in the second, fourth, and final fifth waves of Elliott waves. In particular, if you find this pattern in the second wave, the next wave, the third wave, is likely to be a very stable rising market. In other words, this is a good time to consider new buying positions.

Furthermore, there are two types of ending diagonals: contracting and expanding. The contraction type gradually narrows in shape, while the expansion type has a shape that widens in the opposite direction. It is best to look for these patterns while keeping the zigzag shape in mind.

FX Diagonal Cautions

While diagonals provide traders with unique insights, there are some points that require attention. Specifically, the following three points should be noted ↓.

- There are no clear buy/sell signals and it is a personal decision.

- It is not possible to predict the market perfectly.

- Practical practice is essential to mastering its use.

Due to the characteristics of diagonals in the market, buy and sell signals are not always clear, and traders are required to use their judgment. In addition, it is difficult to completely predict the future of the market, and it is essential to trade with a full understanding of the risks involved. Furthermore, in order to master the use of diagonals, practical practice as well as theory is essential. Let’s take a closer look at each of these precautions.

There are no clear buy/sell signals and it is a personal decision.

A diagonal pattern is a specific shaped pattern that appears in the market, but it does not indicate a clear buy or sell signal. Even if a trader finds this pattern, he or she must use his or her own judgment in making trades. They must look closely at other technical analysis tools and the overall movement of the market, and then make their own decisions.

In addition, what a diagonal pattern means can change depending on the situation. The information indicated by this pattern cannot be generally said to be “correct” because it is interpreted differently depending on the state of the market at the time and the trader’s own experience and knowledge. Therefore, it is important for traders to use this pattern carefully in accordance with their own trading strategies.

Simply put, it is important not to trade immediately after finding a diagonal pattern, but to analyze it carefully yourself and consider it in conjunction with other indicators. The market is constantly changing, and you should trade with a broad perspective rather than relying on one pattern alone.

It is not possible to predict the market perfectly.

The future of the market cannot be completely predicted. Diagonal patterns and other tools of technical analysis are not perfect and can be fallacious. Traders should always be aware of market uncertainty and risk management is important.

An analysis such as diagonal patterns only shows one possibility, and when trading based on them, decide on a stop loss or a target price to lock in profits to limit risk. Market movements are difficult to predict and often do not go as planned. Therefore, prepare a flexible trading strategy and be prepared to deal with any situation.

To be successful in the market, it is very important to have not only the skill to use analytical tools, but also the risk management to accept and deal with uncertainty. Please check the Daily Report published on ThreeTrader’s official page every morning, which lists the economic indicators that are attracting attention.

Practical practice is essential to mastering its use.

To use diagonal patterns successfully, it is necessary to practice not only in theory but also in actual market conditions. Basic knowledge is important, of course, but being able to recognize patterns in actual market conditions is extremely important. Finding diagonal patterns in a fluctuating market requires experience. It is a good idea to open a chart and look for areas where diagonal patterns have occurred in past markets.

By practicing real trades, traders learn how to respond to different situations in which diagonal patterns appear. A demo account allows you to practice trading with these patterns without having to spend real money.

Once you get used to the demo account, you can try it out on a real market.

Click here to open a live account

Utilize diagonals with Threetrader

For beginners who want to learn about utilizing diagonals, a good way to do so is to use the ending diagonal, the fifth wave that appears at the end of a trend. Although there is no specific indicator for diagonal patterns, they tend to be easy to spot, especially in overheated currency pairs and stocks.

ThreeTrader provides information on hot stocks, currency strength and weakness, important economic indicators, and fundamentals through our Market Reports. The Daily Market Report is updated every morning and we recommend checking it daily. This will give you trading tips utilizing diagonal patterns and help you read the market more effectively.

The Weekly Report provides a list of important economic indicators for the week. Check the weekly Sunday report as well, as it can trigger breakouts and trend changes. Follow our official X (formerly Twitter) account to receive notifications and be less likely to miss an article.

When developing a trading strategy using diagonals, it is important to use this information to find the right approach for the current market conditions. By reading the daily market reports, you will be able to make smart trading decisions in line with market movements.

Click here to open a live account

Summary|FX Diagonal

This article focused on diagonals in FX and introduced the typical patterns “leading diagonals” and “ending diagonals.

Diagonals are market analysis tools based on Elliott Wave Theory, and leading and ending diagonals are its main derived patterns. Leading diagonals predict the formation of a new trend, while ending diagonals conversely indicate the end of a trend.

It is important to note that diagonals do not always provide definitive buy or sell signals and require the trader’s judgment. Since it is difficult to completely predict the future of the market and risk management is crucial, ThreeTrader also provides a means to support the analysis of diagonals.

In summary, diagonals are an important tool for identifying market turning points, and understanding and utilizing leading and ending diagonals will enable traders to be more responsive to market changes. With risk in mind, use diagonals to improve the accuracy of your trades.